In today’s digital age, payment processing plays a pivotal role in the success of online businesses. Whether you’re running an e-commerce store, a subscription-based service, or a donation platform, having a reliable payment gateway is essential. Stripe, a leading player in the payment processing industry, has emerged as a favorite choice for businesses worldwide. In this comprehensive guide, we will delve into the world of Stripe payments, exploring its features, benefits, and how to integrate it into your online business seamlessly.

TABLE OF CONTENTS

- What is Stripe?

- The Evolution of Online Payments

- Why Choose Stripe?

- Setting Up Your Stripe Account

- Understanding Stripe’s Dashboard

- Integrating Stripe on Your Website

- Stripe Payment Methods

- Handling Subscriptions with Stripe

- Stripe’s Security Measures

- Managing Disputes and Refunds

- Reporting and Analytics with Stripe

- Stripe Connect: Expanding Your Business Horizons

- Mobile Payments with Stripe

- International Expansion with Stripe

- Pricing and Fees

1. What is Stripe?

Stripe is an online payment processing platform that allows businesses to accept payments over the internet. Founded in 2010 by Irish entrepreneurs Patrick and John Collison, Stripe has become a global leader in the fintech industry. It provides a robust and developer-friendly infrastructure for accepting payments, managing subscriptions, and handling various aspects of online transactions.

2. The Evolution of Online Payments

Before diving deeper into Stripe, let’s take a brief look at the evolution of online payments. From the early days of e-commerce, where credit card payments were fraught with security concerns, to the present, where digital wallets and mobile payments are commonplace, the payment landscape has transformed significantly.

3. Why Choose Stripe?

So, what sets Stripe apart from other payment processors? One word: simplicity. Stripe is known for its user-friendly interface, seamless integration options, and an extensive range of features that cater to businesses of all sizes. Whether you’re a startup or a Fortune 500 company, Stripe provides the tools you need to accept payments effortlessly.

4. Setting Up Your Stripe Account

Getting started with Stripe is a breeze. We’ll walk you through the process of creating your Stripe account, verifying your identity, and setting up your payment gateway.

5. Understanding Stripe’s Dashboard

Once your account is set up, it’s essential to familiarize yourself with Stripe’s dashboard. Here, you can manage transactions, view analytics, and access various features to streamline your payment processing.

6. Integrating Stripe on Your Website

Now, it’s time to integrate Stripe into your website. We’ll provide step-by-step instructions and tips for a smooth integration process.

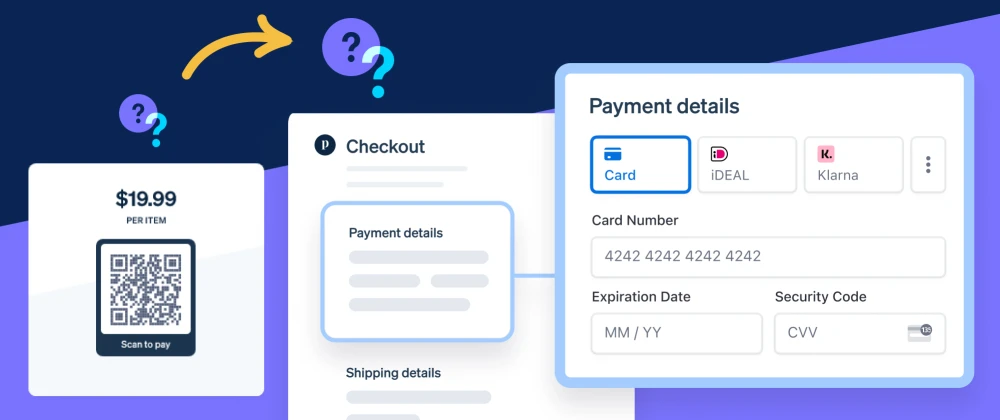

7. Stripe Payment Methods

Stripe supports various payment methods, from credit cards to digital wallets. Learn how to offer your customers a range of payment options.

8. Handling Subscriptions with Stripe

For businesses that offer subscription-based services, Stripe’s subscription management tools are a game-changer. Discover how to set up and manage recurring payments.

9. Stripe’s Security Measures

Security is a top priority for both businesses and customers. We’ll discuss Stripe’s robust security measures and how they protect your transactions.

10. Managing Disputes and Refunds

Occasionally, disputes and refunds are part of online business. We’ll guide you through the process of handling these situations efficiently.

11. Reporting and Analytics with Stripe

Data is crucial for making informed decisions. Learn how to leverage Stripe’s reporting and analytics tools to gain insights into your business.

12. Stripe Connect: Expanding Your Business Horizons

If you’re looking to scale your business, Stripe Connect offers a platform for building marketplaces and platforms.

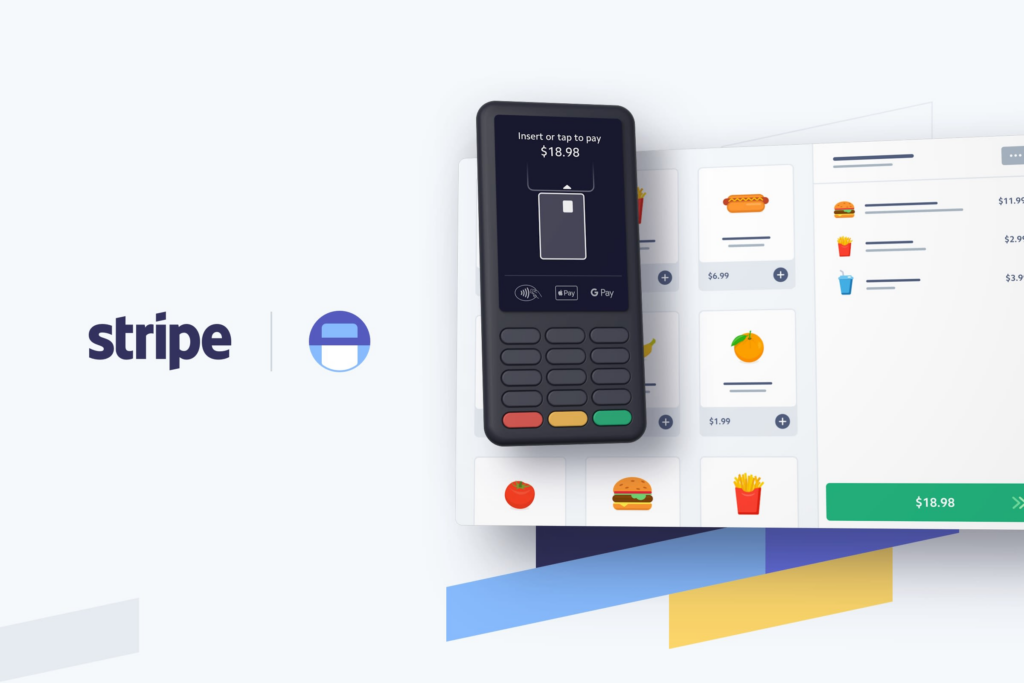

13. Mobile Payments with Stripe

With the growing popularity of mobile commerce, Stripe offers solutions for accepting payments on mobile devices.

14. International Expansion with Stripe

Thinking of expanding globally? Stripe’s international capabilities make it a breeze to accept payments from customers worldwide.

15. Pricing and Fees

We’ll break down Stripe’s pricing structure, so you know what to expect in terms of fees and costs.

CONCLUSION

Stripe is more than just a payment processor; it’s a comprehensive solution for businesses to thrive in the digital economy. By following this guide, you’ll be well-equipped to harness the power of Stripe and provide your customers with a seamless payment experience.