In today’s rapidly evolving business landscape, staying competitive and adaptable is crucial for success. Access to timely and flexible financing options is a key factor that can make or break a business’s growth prospects. Enter Kabbage, a financial technology company that has been transforming the way small and medium-sized businesses access capital. In this article, we’ll delve deep into the world of Kabbage financial technology, exploring its innovative solutions, the benefits it offers to businesses, and how it has revolutionized the traditional lending landscape.

THE GENESIS OF KABBAGE

Kabbage was founded in 2009 by Rob Frohwein, Marc Gorlin, and Kathryn Petralia. The trio had a vision of simplifying and democratizing access to capital for small businesses. They aimed to leverage technology to provide a seamless and efficient lending process. Today, Kabbage is a subsidiary of American Express and continues to be a pioneer in the fintech industry.

UNDERSTANDING KABBAGE’S OFFERINGS

1. Kabbage Loans: Quick and Convenient

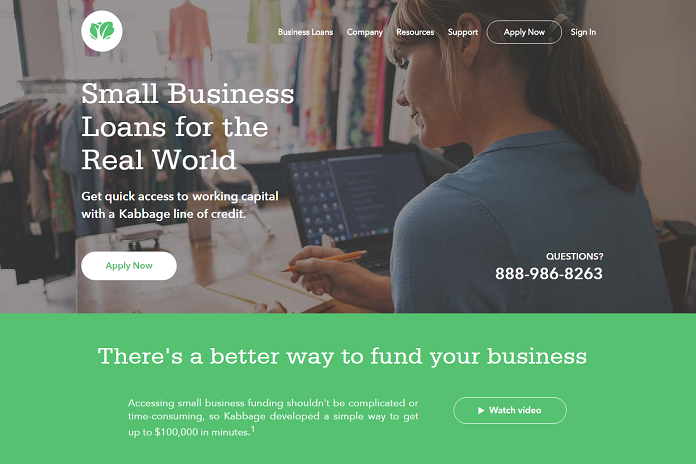

Kabbage offers fast and convenient loans for small businesses. With their automated application process, businesses can access funds in a matter of minutes. This is a game-changer for companies facing urgent financial needs or unexpected opportunities.

2. Flexible Line of Credit: Borrow What You Need

Kabbage provides a revolving line of credit, allowing businesses to borrow the amount they require when they need it. This flexibility ensures that companies don’t overextend themselves financially and can manage their cash flow effectively.

3. Kabbage Payments: Simplifying Transactions

Kabbage Payments is another innovative solution that enables businesses to accept card payments easily. This feature enhances a business’s ability to cater to a broader customer base and improve revenue streams.

THE KABBAGE DIFFERENCE

Kabbage stands out in the world of financial technology for several reasons:

1. Speed and Convenience

Traditional lending institutions often involve lengthy application processes and rigorous credit checks. Kabbage streamlines this by leveraging technology to assess a business’s health quickly. This ensures that businesses get the funds they need without unnecessary delays.

2. Inclusivity

Kabbage’s commitment to democratizing access to capital means they are more willing to work with businesses that might not meet the stringent requirements of traditional banks. This inclusivity is a lifeline for many small businesses.

3. Data-Driven Decision Making

Kabbage relies on data analytics and artificial intelligence to make lending decisions. This allows them to assess risk more accurately and offer tailored financing solutions.

4. Personalized Experience

Kabbage understands that every business is unique. Their offerings are designed to cater to individual business needs, ensuring a personalized experience for each client.

SUCCESS STORIES

The impact of Kabbage financial technology can be best understood through success stories. Countless businesses have thrived thanks to their support. From restaurants to e-commerce stores, Kabbage has been a reliable partner in growth.

CONCLUSION

Kabbage financial technology has reshaped the financing landscape for small and medium-sized businesses. With its speed, inclusivity, and data-driven approach, it has become a beacon of hope for those in need of capital. The fintech industry owes much of its transformation to innovative companies like Kabbage, making it possible for businesses to thrive in an ever-changing world.