INTRODUCTION

In today’s digital age, online transactions have become an integral part of our daily lives. One name that has played a pivotal role in shaping the landscape of online payments is PayPal. This article delves into the history, evolution, and impact of PayPal in the world of e-commerce and digital finance.

The Birth of PayPal

PayPal was founded in December 1998 under the name Confinity by Max Levchin, Peter Thiel, and Luke Nosek. Initially, it aimed to create security software for handheld devices. However, the company soon shifted its focus to developing a digital wallet.

The Merger and the Birth of PayPal

In March 2000, Confinity merged with X.com, an online banking company founded by a visionary entrepreneur, Elon Musk. The result of this merger was a comprehensive online payment platform, and X.com was later renamed PayPal in 2001.

PayPal’s Breakthrough: A Global Payment Solution

PayPal’s genius lies in its simplicity and convenience. Users can link their bank accounts or credit cards to their PayPal accounts, eliminating the need to share sensitive financial information with multiple online vendors. This innovation made online shopping more secure and accessible to millions.

Security Measures

One of PayPal’s key features is its robust security system. It employs cutting-edge encryption technology and fraud detection algorithms to safeguard user transactions. Buyers and sellers can feel confident that their financial data is protected.

THE EVOLUTION OF PAYPAL

Expanding Horizons

As online commerce grew, PayPal expanded its services beyond eBay, becoming a trusted payment method for numerous online retailers. Its popularity skyrocketed, and in 2002, eBay acquired PayPal, recognizing its potential to enhance the online shopping experience.

PayPal Beyond Borders

PayPal’s influence transcended national boundaries. It started supporting multiple currencies, making it a versatile choice for international transactions. This globalization was a game-changer for businesses worldwide, enabling them to tap into a global customer base.

Mobile Payments

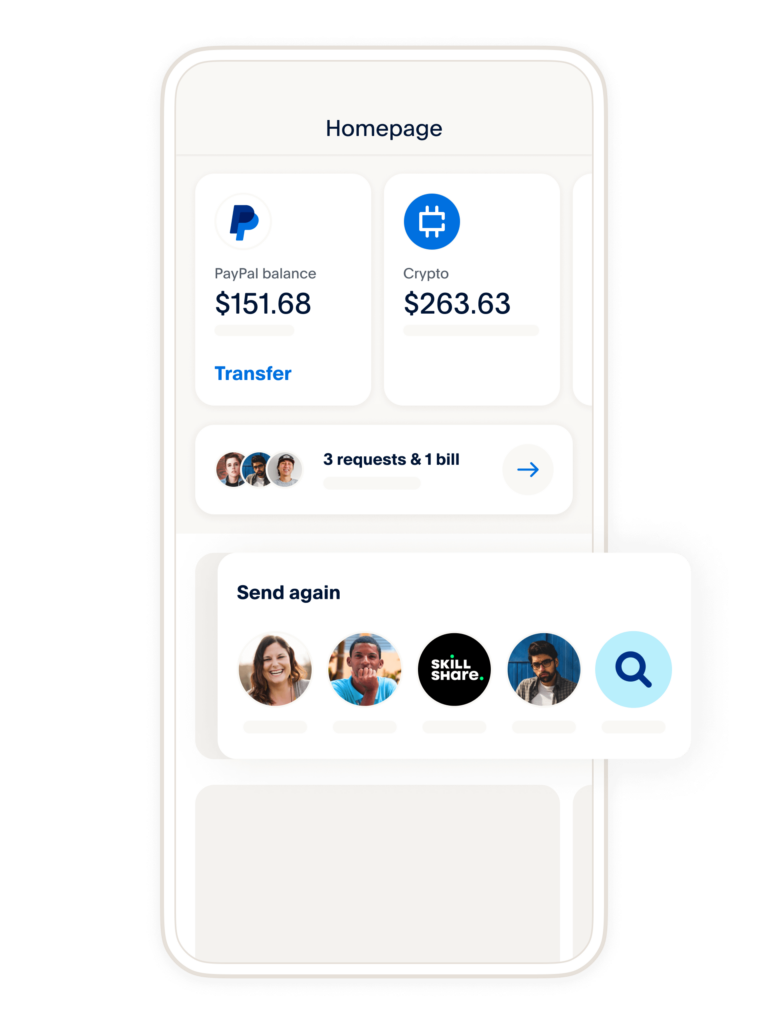

With the advent of smartphones, PayPal adapted once again. It introduced mobile payment options, allowing users to make transactions on-the-go with just a few taps on their phones. This innovation catered to the increasing demand for mobile commerce.

PAYPAL TODAY

A Financial Powerhouse

PayPal has grown into a financial juggernaut. In 2015, it split from eBay to become an independent company again. Its user base has expanded to over 400 million active accounts, and it continues to be a trusted name in online payments.

PayPal and Cryptocurrency

In 2020, PayPal took a significant step by allowing users to buy, hold, and sell cryptocurrencies like Bitcoin and Ethereum within their PayPal wallets. This move marked the integration of digital currencies into mainstream finance.

CONCLUSION

In conclusion, PayPal has revolutionized the way we conduct online transactions. From its humble beginnings as Confinity to its current status as a global financial powerhouse, PayPal’s journey has been nothing short of remarkable. Its commitment to security, convenience, and innovation has made it a household name in the world of digital finance.